Our Portfolio

-

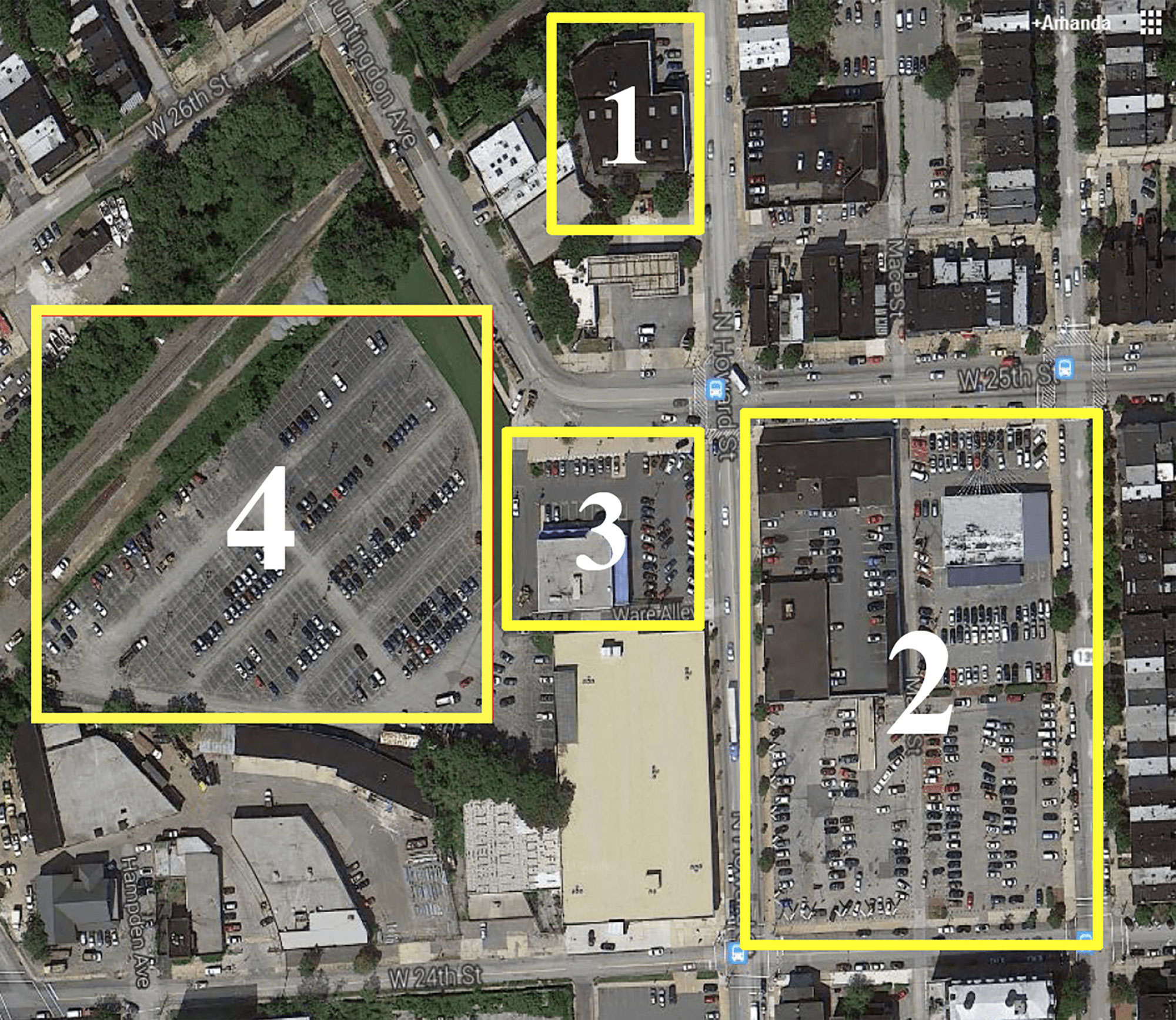

25th St. Station

Baltimore, MD 21218

View Property

25th St. Station

Baltimore, MD 21218

View Property

-

1209 N. Charles St.

Baltimore, MD 21201

View Property

1209 N. Charles St.

Baltimore, MD 21201

View Property

-

Cathedral Crossing

Baltimore, MD 21201

View Property

Cathedral Crossing

Baltimore, MD 21201

View Property

-

220 W Saratoga St.

Baltimore, MD 21201

View Property

220 W Saratoga St.

Baltimore, MD 21201

View Property

-

5960 Belair Rd.

Baltimore, MD 21206

View Property

5960 Belair Rd.

Baltimore, MD 21206

View Property

-

305 S. Atwood Rd.

Bel Air, MD 21014

View Property

305 S. Atwood Rd.

Bel Air, MD 21014

View Property

-

880 Park Ave.

Baltimore, MD 21201

View Property

880 Park Ave.

Baltimore, MD 21201

View Property

-

Box Hill Office Park

Bel Air South, MD 21009

View Property

Box Hill Office Park

Bel Air South, MD 21009

View Property